What are the advantages of changing over to solar power in Texas?

In another report from the SEIA (Solar Energy Industries Association), Texas has extended its solar power limits by 60% in less than a year!

The Benefits of Solar Power

A few benefits of solar Power to Choose from are:

Specifically, it is boundless. Business Standard News reported that we are most likely going to run out of oil in the coming 53 years, vaporous petroleum in 54, and coal in 110. We have burned through these resources so rapidly (from a genuine perspective devoured them) and right after existing on this planet for an enormous number of years, we have blown through them in a ruinous season of 200 years.

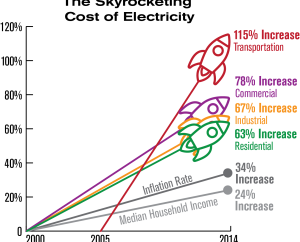

The Savings are Staggering – As Carol Mark’s found on the Penny Hoarder Blog, her bills went from upwards of $300 to $45 every month. It has similarly lessened by near 100% over the last 75 years, which is a record-breaking flip of moderateness. With costs being at $300 per watt in 1956, and by and by around $3.00 per watt, the hold assets can be in the upper region of $30,000 across 25 years, with rates set to end up being ceaselessly reasonable.

Benefit from Investment and Higher Property Values – In an age where the world is changing to veggie-lover, heartlessness free, ordinary things, and harmless to the ecosystem power, a steadily expanding number of home buyers will be looking for a home that satisfies their ethical rules of not requiring a huge carbon impression. This will logically have significance in the next decade’s real estate market. As Wells Solar depicts, at “generally $4.00 per watt of presented solar cutoff. For an ordinary 6-Kilowatt solar PV system, this suggests that solar can add $24,000 to your home’s resale value!”

Solar power offers a source that we have a lot of – Sunshine! Imagine the hold finances when you don’t have to rely upon energy sources and extravagant expenses to set up your suppers and do your attire. All you need is a splendid day and a solar board, and you’re all set!

The Texas Tax Credit – Yes, this remarkable state will moreover offer you a cost relief for joining their undertakings. Covered all around in the accompanying region.

Texas Incentives – Solar Tax Credit

Texas is changing following these economical drives as in front of the entire country. With Texas already beating a part of their harmless ecosystem power destinations in 2009 that they were set to complete in 2025, this state has at this point acquired stunning ground in the energy disturbance.

As Texas has placed $916 million in Solar Installations in 2016 alone, the state needs to offer its occupants a little gift, push, inspiration, (anything that you’d like to call it) to make the shift. Close by the incomprehensible speculation reserves recently introduced by changing over to solar energy, quick plans are coming to the skirt concerning these Tax allurements. This credit was 30% in 2019 anyway and has likely lessened to a 26% duty decrease in 2020, set to be a substantially more unassuming tax reduction of 22% by 2021. Later 2021, this assessment will decrease and evaporate. It can without a very remarkable stretch save you $5,000+, yet this managerial help won’t continue to go for long.